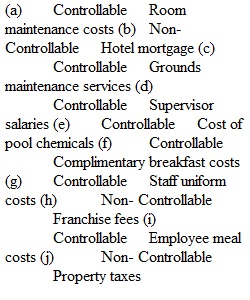

Q Worksheet for Managerial Accounting for Costs #2 (Chapter 9) MGT 225 - Managerial Accounting 1. Fixed costs, variable costs, mixed costs, step costs, direct costs, indirect costs, joint costs, incremental costs, standard costs, sunk costs, opportunity costs, and so on. If Raj Patel heard his dad talk about any more kinds of costs, he thought he would go crazy. His dad was the company owner and accountant. Raj had just taken his first property manager's job in his father's 10?property hotel company. “The most important costs,” said his dad, “are those you can control. ”That really doesn't make any sense, thought Raj, all costs are controllable, just close the hotel and all the costs are gone! Raj thought that was a pretty funny way to look at costs, but his dad … not so much! Raj really did know that his job was to keep his assigned property operating at a high level of profit, and to do so he would need to be seriously concerned about the expenses he could control. Help Raj identify his controllable costs by placing the term “Controllable” before those costs typically controlled by a property general manager and “Non?controllable” before those that a property manager would likely not control. Controllable or Non?controllable Cost (a) Room maintenance costs (b) Hotel mortgage (c) Grounds maintenance services (d) Supervisor salaries (e) Cost of pool chemicals (f) Complimentary breakfast costs (g) Staff uniform costs (h) Franchise fees (i) Employee meal costs (j) Property taxes (k) Electronic key card costs (l) Staff training (m) Interest expense (n) Internet advertising (o) Income taxes (p) Office supplies (q) In?room guest amenities (r) Insurance costs (s) Electrical usage (t) Assistant manager's bonus 2. Tutti's Sandwich Shop has the following information regarding costs at various levels of monthly sales. Help Tutti separate her costs into fixed costs and variable costs so that she can predict and evaluate her costs at varying levels of guests served. January ($) February ($) March ($) Monthly Sales in Guests Served 10,000 16,000 20,000 Cost of Sales (Food Cost) 10,500 16,800 21,000 Salaries, Wages, and Benefits 15,000 15,600 16,000 Telephone 12,750 16,350 18,750 Rent on Building ?2,400 ?2,400 ?2,400 Depreciation of Equipment ? 600 ? 600 ? 600 Utilities ?1,000 ?1,300 ?1,500 Maintenance and Repairs ? 500 ? 740 ? 900 Administrative Costs ?2,600 ?2,600 ?2,600 Item Variable Cost per Guest Fixed Costs Cost of Sales (Food Cost) 0 Salaries, Wages, and Benefits 14,000 Telephone 6,750 Rent on Building Depreciation on Equipment Utilities 500 Maintenance and Repairs Administrative Costs Total $ $ A. Develop a total cost equation for Tutti that she can use at any volume of sales. Total Costs = Fixed Costs + (Variable Cost per Guest × Number of Guests) Total Costs = X B. Determine if Tutti is controlling her costs in April as well as she did in January, February, and March. She sold sandwiches to 30,000 guests in April. Calculate her expected costs based on her actual number of guests. Expected costs based on the total cost equation: Total Costs = Fixed Costs + (Variable Cost per Guest × Number of Guests) 30,000 C. Her actual total costs in April were $81,500. Were her actual costs in April higher or lower than expected based on her total cost equation, and was this a favorable or unfavorable variance? Were actual costs higher or lower than expected? Were actual costs favorable or unfavorable? 3. Mark Chaplin is the manager of Carsen's Rib Joynt, a restaurant specializing in baby back ribs, but serving them in a very upscale atmosphere. Mark has nearly completed calculating his prime costs for the months of July, August, and September of this year. He is seeking to forecast his staff costs for the month of October. He knows the following information: Monthly Management costs $42,000 Total benefits costs ?20% Because his monthly management costs are fixed at $42,000 and his benefit costs are 20% of management and staffing expense, the cost of staff is the only labor?related cost he wants to estimate based on his forecasted volume. Complete Mark's prime cost recap sheet, answer the questions that follow, and then make the staff expense forecasts he needs to better predict his staff costs at the various number of guests served estimates he has identified. Carsen's Rib Joynt July August September NUMBER OF COVERS SALES 12,000 14,500 13,000 Food $302,500 $410,500 $350,750 Beverage $62,250 $85,250 $65,500 ?Total Sales COST OF SALES Food $105,875 $143,650 $122,750 Beverages $13,250 $16,750 $14,750 ?Total Cost of Sales LABOR Management Staff $127,000 $132,625 $130,000 Employee Benefits ?Total Labor PRIME COST $ $ $ (a)?What is the operation's variable “staff” cost per guest? $ (b)?What was the operation's total variable “staff” cost in July? $ (c)?What is the fixed portion of “staff” costs? $ Estimated Number of Guests Served Fixed Staff Costs ($) Variable StaffCosts ($) Total (Mixed) Staff Cost ($) 13,250 13,500 13,750 14,000 d. What will be the operation's total “staff” cost if the following numbers of guests are estimated to be served in October? 4. Betty Stout is the dining room manager at the Fairview hotel. Betty's restaurant is very busy when the 520?room hotel housing her restaurant experiences high levels of occupancy, but it is slower when the hotel's occupancy is reduced. From past history, Betty knows that service in her dining room is best when she schedules one server for every 50 rooms occupied. Thus, for example, on a Friday night when the hotel sells 380 rooms, Betty must schedule eight servers for Saturday morning (380 rooms sold/50 servers per room = 7.6 servers). Each server scheduled by Betty will work a 6?hour shift and they are paid $17.00 per hour. Betty has just received next week's occupancy forecast from the hotel's director of sales (DOS). Help Betty complete her breakfast staffing worksheet to determine how many breakfast servers she must schedule each day next week, and then answer the questions that follow. Betty's Breakfast Server Worksheet Date Day of Week Rooms Available Occupancy Forecast (%) Number of Servers per Forecast Number of Servers Scheduled Server Cost ($) Server Cost per Occupied Room ($) 20?Oct Sunday 520 35.5 21?Oct Monday 520 60.0 22?Oct Tuesday 520 62.5 23?Oct Wednesday 520 68.0 24?Oct Thursday 520 86.5 25?Oct Friday 520 95.0 26?Oct Saturday 520 91.5 27?Oct Sunday 520 N/A Total 1. On what day(s) will Betty schedule the fewest number of breakfast servers? 2. On what day(s) will Betty schedule the greatest number of breakfast servers? 3. On what day(s) will Betty's total cost of breakfast server staff be lowest? 4. On what day(s) will Betty's total cost of breakfast server staff be highest? 5. What will be Betty's estimated total breakfast server expense for the week? 6. On what day will Betty's server cost per occupied room be lowest? 7. On what day will Betty's server cost per occupied room be highest? 8. Why is your answer to question (f) different from your answer to question (g) above? 9. Can Betty sum the seven individual days “server cost per occupied room” then divide by seven to get her average server cost per occupied room (CPOR) for the week? Why or why not? Dopson, Lea R., David Hayes. Managerial Accounting for the Hospitality Industry, 2nd Edition. Wiley, 2016-11-28. VitalBook file.

View Related Questions